georgia property tax exemptions disabled

You can also appeal via regular mail in writing on or before the deadline. California veterans with a 100 PT VA disability rating are closely watching Senate Bill SB-1357.

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Secretary of Veterans Affairs.

. Types of Property Tax Exemptions in Georgia To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. The amount is 93356 during FY 2022 per 38 USC.

Complete Edit or Print Tax Forms Instantly. This bill will grant veterans who have a 100 percent PT VA disability rating a full property tax exemption on their primary residence effective January 1 2023 the bill continues for 10 years through January 1 2033. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt from the school tax.

Chief Tax Appraiser Roy G. The qualifying applicant receives a substantial reduction in property taxes. The only disabled property tax exemption in the state of Georgia is reserved for veterans.

Property Tax Exemptions for Disabled Veterans by State Alabama Property Tax Exemptions. Complete Edit or Print Tax Forms Instantly. DeKalb County offers our disabled residents special property tax exemptions.

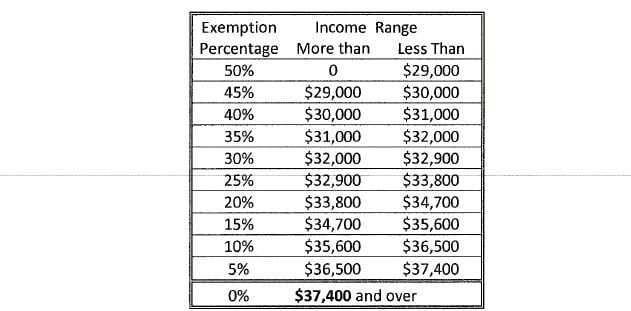

For information in regard to the Exemptions listed below please call the Tax Assessors office at 770-288-7999 opt. Disabled Veterans S5 - 100896 From Assessed Value. Disabled Person - 50 School Tax Exemption coded L5 or 100 School Tax Exemption coded L6 If you are 100 disabled you may qualify for a reduction in school taxes.

Ad Complete Tax Forms Online or Print Official Tax Documents. Applicants may also qualify for this exemption if 100 disabled regardless of age with a signed letter from your doctor stating you are unable to be gainfully employed. To appeal the valuations click here for instructions or see the instructions in the top right hand corner of the assessment notice.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Chief Deputy Appraiser Stephanie Gooch. In 2022 the additional sum is.

Veterans who qualify for the Purple Heart or Medal of Honor specialty license plates are also exempt. You must be 65 years old as of January 1 of the application year or 100 totally and permanently disabled and must occupy your residence within the Gwinnett County School. There are several property tax exemptions in Georgia and most are pointed towards senior citizens and service members.

The Senior School Tax Exemption L5A provides a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up to one acre of property. Georgia exempts a property owner from paying property tax on. Heres a brief overview in the table below.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. The current amount is 85645. Compare to line 15C of your Georgia tax return.

Includes 10000 off the assessed value on County4000 off County bond10000 off school 10000 off school bond and. A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally and permanently disabled is required to qualify for this exemption GA Code 48-5-48. For more information on vehicle tax exemptions contact your local County Tax Office.

Learn More At AARP. If youre a disabled veteran youll qualify for up to a 60000 exemption and perhaps an additional amount as determined by the Department of Veterans Affairs. You must be at 100 permanently and totally disabled and you must meet certain income requirements.

The Georgia State Constitution provides for property tax exemptions to a homestead property owned by a taxpayer and occupied as a legal. The exemption is granted on ONLY one vehicle the veteran owns and upon which the free Disabled Veteran DV license plate is attached. Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes.

Under Alabamas homestead exemption. Ad Access Tax Forms. The exemption is 50000 off school tax and 15000 off county.

Qualified veterans in Georgia may receive a property tax exemption for a primary residence of up to 50000 plus an additional amount which varies annually. Up to 25 cash back If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. The additional sum is determined according to an index rate set by United States Secretary of Veterans Affairs.

Complete Tax Forms Online or Print Official Tax Documents. Currently there are two basic requirements. Items of personal property used in the home if not held for sale rental or other commercial use all tools and implements of trade of manual laborers in an amount not to exceed 2500 in actual value domestic animals in an amount not to exceed 300 in actual value.

Totally Disabled Code L12 Under Age 65You must be 100 disabled documented by two doctors letters or one doctors letter and Social Security award letter. To apply for a disabled exemption you will need to bring your Georgia drivers license your Social Security Awards Letter and one Doctors Affidavit completed by your doctor. Property in excess of this exemption remains taxable.

Pdf Land And Property Tax A Policy Guide

Respect The Flags Respect The Flag Safety Topics Bury

Property Tax Circuit Breakers In 2019 Itep

Pdf Land And Property Tax A Policy Guide

El Paso City Leaders To Discuss Lowering Property Tax Kdbc

Veteran Tax Exemptions By State

Pdf Land And Property Tax A Policy Guide

Pdf Land And Property Tax A Policy Guide

Veteran Tax Exemptions By State

Property Tax Exemptions For Disabled Veterans Mhs Lending

Are There Any States With No Property Tax In 2021 Free Investor Guide Retirement Money Social Security Benefits Retirement Retirement Advice

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Millage Rates Newton County Tax Commissioner

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com